14 February 2024

MEDIA ALERT

The rise of plant-based meat: reshaping retail in Australia

The volume and types of plant-based meats in Australian retail have changed significantly over the past three years.

What’s clear is that a new food category has emerged from one or two niche players to create an industry that’s here to stay.

In major retail in Australia, the plant-based meat category has gone from fewer than five brands made by Australian/NZ businesses in 2017, to more than 30.

There has also been a three-fold increase in the number of products on shelves over the last few years, from less than 90 to just under 300.

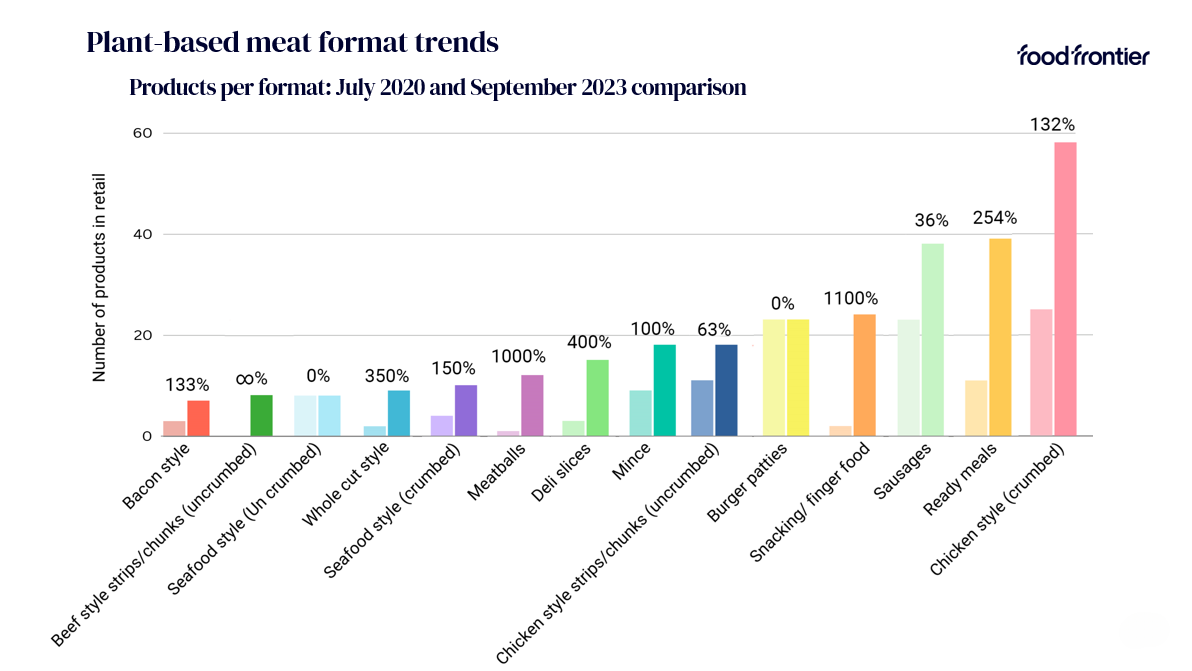

According to data from independent alternative protein think tank Food Frontier, the types of products are shifting too. Consumers are looking for convenience, which has seen a significant increase in the supply of formats like schnitzels and nuggets, through to mince and meatballs, and to deli slices, snacking and finger foods.

Consumer interest in products that can be incorporated into a variety of dishes has seen more versatile, functional formats hit shelves, like beef-style strips and chunks, and whole cut style—although there are still fewer than 10 products of each in-market.

The findings are the results of audits of major supermarkets in Melbourne and Sydney in mid-2023.

CEO of Food Frontier, Dr Simon Eassom, says the findings show that the Australian plant-based meat market is still evolving and maturing. “We know that the early adopters of plant-based meats in Australia and around the world are flexitarians—they are the cohort, used to centre-of-plate proteins or protein-based dishes, that are now looking for healthier alternatives to those conventional protein sources and for products that mimic what they’re used to buying.

“When plant-based options first appeared on our shelves in Australia, about six years ago, they were mostly in the form of utility foods: sausages and burgers. There were probably too many manufacturers all providing the same style of product and, rightly so, customers have voted with their taste-buds and their wallets. This category has seen zero increase and some contraction in terms of the number of manufacturers, with the lion’s share of the market now dominated by a few strong brands. The data gathered by Food Frontier indicates that other formats that can be incorporated into a much wider range of dishes are gaining favour and manufacturers are responding accordingly.”

Overall, the number of plant-based meat products available in Australia peaked at about 350 in early 2023 and, as expected in new food categories, there has since been consolidation.

“We expect the category to continue to evolve and we wouldn’t be surprised to see further changes by way of company integration, and product formulations. This is a food industry that’s continuing to innovate and adapt to consumer tastes and budgets, plus the availability of more sophisticated ingredients will help manufacturers improve products to meet expectations around taste and texture as well as price.”

Australian and New Zealand brands now make up two-thirds of products in major retail in Australia—up from less than half in 2019—with international brands that trail–blazed plant-based meats still holding their own: brands such as Beyond Meat, Impossible Foods and Fry Family Food.

In 2019, Food Frontier and Deloitte Access Economics estimated the domestic plant-based meat industry could be worth $3bn by 2030 with CSIRO predicting a $6bn industry for all plant-based products.

Food Frontier will release its third state of the industry report in mid-2024 which will provide up to date insights into the value of the industry and updated 10 year projections, taking into account current macroeconomic conditions.

Extra info:

There are 26 plant-based meat manufacturers in Australia and New Zealand—from small start-ups to family-run meat and butchery businesses, to small medium enterprises and large players. Eleven are based in NSW; six in Victoria; three in Queensland; five in New Zealand and one in South Australia. For a list of brands see this map.

Media contact:

Kathy Cogo, Head of Communications and Marketing, Food Frontier kathy@foodfrontier.org,

0466 015 183.

About

Food Frontier is the independent think tank on alternative proteins in Australia and New Zealand. Funded by grants and donations, our work is growing our region’s protein supply with new, sustainable and nutritious options that create value for businesses, farmers and consumers.